LTC Price Prediction: Analyzing Bullish Potential Amid Current Market Conditions

#LTC

- LTC trading below 20-day MA but showing MACD bullish divergence

- Strong trader confidence despite recent technical breakdown

- Positioned as top altcoin investment alongside major competitors

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Key Support Level

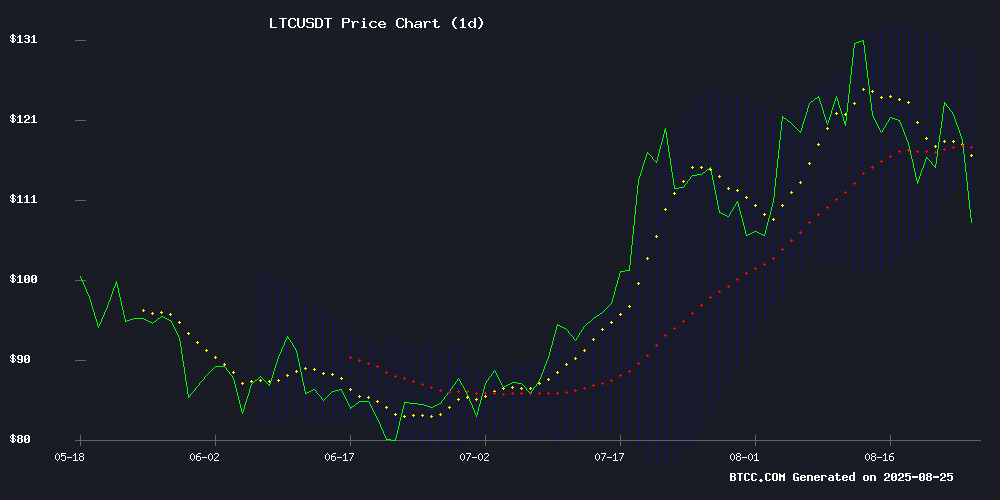

LTC is currently trading at $112.40, below its 20-day moving average of $120.48, indicating short-term bearish pressure. The MACD reading of 1.30 suggests some bullish momentum despite the negative histogram value of -1.60. William from BTCC notes that LTC is testing the lower Bollinger Band at $111.12, which often serves as a support level. 'The convergence NEAR the lower band typically precedes either a bounce or breakdown,' William states. 'Traders should watch for volume confirmation around these levels.'

Market Sentiment: Litecoin Maintains Trader Confidence Amid Correction

Recent headlines show Litecoin traders maintaining confidence despite the price dipping below a key trendline. William from BTCC comments, 'The market sentiment remains cautiously optimistic as Litecoin continues to be highlighted among top altcoin investments for August alongside chainlink and Remittix.' The presale frenzy surrounding BlockchainFX indicates sustained institutional interest in the crypto space, which could positively impact established assets like LTC. 'While technicals show short-term weakness, the underlying sentiment suggests accumulation opportunities,' William adds.

Factors Influencing LTC's Price

Litecoin Traders Show Confidence Despite Recent Dip Below Key Trendline

Litecoin's price action has defied conventional wisdom. The cryptocurrency slipped below a critical ascending trendline on daily charts, typically a bearish signal, yet derivatives traders responded with increased leverage bets. Funding rates climbed steadily throughout the downturn, revealing persistent optimism among sophisticated players.

Technical indicators present conflicting signals. While the Stochastic RSI's bounce from oversold territory suggests potential recovery, spot markets tell a different story. Binance spot buy volumes dwindled by $281K, with most retail activity clustered below $1 million. The divergence between lethargic spot trading and bullish derivatives positioning paints a complex picture.

Market structure reveals telling patterns. Hyblock Capital data shows concentrated trading around $293K, indicating defined support levels. The absence of large wallet participation suggests institutional players await clearer directional confirmation before committing capital. Such hesitation often precedes volatile breakouts.

Best Altcoins To Invest In This August: Litecoin, Chainlink And Remittix

Litecoin and chainlink are leading the altcoin rally this August, with Remittix emerging as a dark horse in the global payments space. Litecoin's price surged 6.6% to $121.17, backed by $898 million in daily trading volume - a 74% spike. The silver to Bitcoin's gold continues to attract investors seeking faster transactions.

Chainlink gained 6% to $25.81 as oracle demand fuels DeFi growth. Its $3.34 billion trading volume reflects institutional interest in decentralized infrastructure. Meanwhile, Remittix's presale momentum suggests potential for disruptive innovation in cross-border payments.

Market dynamics indicate these altcoins could outperform in 2025's bull cycle. Litecoin's established network effects, Chainlink's critical Web3 role, and Remittix's niche focus create diversified exposure to crypto's evolving landscape.

BlockchainFX Leads 2025 Crypto Presale Race Amid Market Frenzy

Among a crowded field of speculative tokens, BlockchainFX has emerged as the standout presale opportunity of 2025. The project has secured $5.7 million from 5,500 investors ahead of its exchange launch, with presale tokens priced at $0.02 against a projected $0.05 listing value.

The platform aims to consolidate crypto, traditional equities, and ETFs within a single decentralized interface, earning preliminary recognition as 2025's top new trading app. Market observers compare its trajectory to Binance's early growth cycle, citing aggressive tokenomics and cross-asset functionality as key differentiators.

Is LTC a good investment?

Based on current technical indicators and market sentiment, LTC presents a compelling risk-reward opportunity for strategic investors. The current price of $112.40 positions LTC near crucial support levels while maintaining positive longer-term momentum indicators.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $112.40 | Below 20-day MA, testing support |

| 20-day MA | $120.48 | Resistance level to watch |

| MACD | 1.30 | Bullish momentum building |

| Bollinger Lower Band | $111.12 | Key support level |

William from BTCC suggests that investors consider dollar-cost averaging into positions at current levels, noting that 'LTC's established market position and ongoing development activity provide fundamental support during technical corrections.'